Welcome to the President’s Market

There was a time when the government’s idea of “market involvement” was holding a hearing, not a portfolio.

But that was before the Genesis Mission.

Today, Uncle Sam is doing something extraordinary – and a little unnerving. He’s acting like the biggest activist investor on Earth, moving billions not with policy memos but with purchase orders.

And if you’re not watching what Washington is buying, you’re already behind.

Over the past few months, the federal government has taken equity stakes in four specific public companies: MP Materials (MP), Intel (INTC), Trilogy Metals (TMQ), and Lithium Americas (LAC).

And the market reaction has been explosive.

- MP Materials soared 50% in a single day after the Pentagon bought a stake.

- Lithium Americas doubled overnight, jumping 100% when the Department of Energy bought in.

- Trilogy Metals didn’t just double; it tripled overnight after the government wrote the check.

And White House officials have already said they intend to keep the cash flowing.

In other words, the most powerful buyer on Earth is repricing strategic national assets at will – creating mouthwatering investment opportunities for traders who know where to look.

If you want to make the most of your time on Wall Street, you’ve got to be positioned in the stocks on the government’s shopping list.

Because this is the “President’s Market.” And frankly, it’s going to make the AI bubble look like a warm-up act…

Why the Federal Government Is Now Picking Stocks

So, why is the government suddenly acting like a desperate venture capitalist? Because America is staring down what could be an ‘economic Pearl Harbor.’

For decades, America has been asleep at the wheel while China systematically captured the raw materials and supply chains that power the 21st century.

Take a look at your smartphone. Without a rare earth mineral called dysprosium, it’s little more than a paperweight. The same goes for your computer, electric vehicle, and the wind turbines and nuclear reactors that power them. Perhaps most importantly, without dysprosium, the U.S. military’s F-35 fighter jets don’t get off the ground.

Yet, China controls:

- Roughly 99% of the dysprosium supply.

- Nearly 90% of the active pharmaceutical ingredients for our drugs (antibiotics, heart meds, you name it).

- 96% of the processing for all rare earth minerals globally.

In 1992, China’s former paramount leader, Deng Xiaoping, famously said, “The Middle East has oil, China has rare earths.”

He knew that if China controlled the inputs, it owned the output. And now, the nation has us in a chokehold.

Beijing has the power to turn off the lights on the American economy tomorrow if it wants.

Mines to Magnets: How Federal Investment Is Rebuilding U.S. Supply Chains

The White House knows this. And that is why we are seeing the activation of something called the NDIS Implementation Plan.

Its official tagline is “Mines to Magnets,” meaning the government isn’t just going to buy a few mines in Nevada and call it a day. It will invest in the entire vertical supply chain.

The U.S. needs to own the mines, the refineries, the processing plants, the chip manufacturers, the energy grid that fuels the AI-driven future…

This is a total retooling of the American economy, reminiscent of the industrial mobilization for WWII. People like JPMorgan (JPM) CEO Jamie Dimon see it coming; that’s why he’s talking about a $1.5 trillion fund for this buildout.

Folks, the government is about to launch the greatest stock buying spree of all time. And I believe they are targeting 119 specific companies to secure our future…

The ‘Cheat Sheet’ for the Next Wave

I’ve been tracking Uncle Sam’s moves for a while. In fact, I recommended MP Materials before the Pentagon bought it; and my subscribers enjoyed the gains.

Now I’m looking at the next wave of opportunities. The government has tipped its hand, giving a preview of the sectors – and the specific types of stocks – that are next on the ‘buy’ list.

The Hidden Rare Earth Stock Washington Needs

Right now, everyone is looking at Lynas Resources. It’s the obvious play. Gina Rinehart, the richest woman in Australia (and a Mar-a-Lago regular), owns it.

But I’m not buying it. It’s already doubled. It’s listed in Australia. And its processing plant is in Malaysia – too close to China.

Instead, I’ve got my eye on a U.S. company one-eighth the size of Lynas. It’s sitting on the largest deposit of heavy rare-earth elements in the United States – over 1 billion tons.

Better yet, it’s not just digging; it’s building a magnet manufacturing facility.

This company is the definition of “Mines to Magnets.” Google co-founder Sergey Brin already owns a 7% stake.

And it’s currently trading for around $20 a share.

The Domestic Chip Manufacturer the U.S. Cannot Afford to Lose

We all love AMD (AMD). I recommended it back in 2015… before it went up 13,500%. But AMD doesn’t make chips; it only designs them. Thus, it relies on foreign manufacturing for its supply.

The U.S. government needs a domestic option.

There is a small firm, started by Jerry Sanders – the exact same legend who founded AMD – that actually manufactures chips.

It’s already inked a deal with the Department of War to supply U.S.-made semiconductors for the next 10 years. And it got $1.5 billion from the CHIPS Act.

Recently, the company’s corporate jet was spotted in Florida… rumored to be parked at Mar-a-Lago.

This is the stock the White House has to back to secure the AI supply chain. And it’s about 1/25th the size of AMD and trades for less than $40/share.

The AI Infrastructure Stock Powering America’s Data Centers

Dell (DELL) is a great company. But it’s also a $100 billion behemoth; the ‘easy money’ is long gone. So, I’m looking at another firm instead.

This one specializes in the critical hardware – liquid cooling and server racks – that keeps AI data centers from melting down. Its revenue is projected to grow 56% next year. And it just built the “Colossus” supercomputer for Elon Musk’s xAI in only 122 days – speed the government loves.

This company could end up as the crown jewel of the American AI buildout, and it trades for just $50.

Small Modular Reactors and the Coming Energy Bottleneck

This could be the sleeper hit of the decade.

AI is an ‘energy vampire.’ In fact, a single AI query uses 10x the power of a regular Google search.

That means that data centers are about to consume more power than many countries; and the grid cannot handle it. Solar and wind are too intermittent. We need baseload power – and the solution lies with nuclear.

But we also can’t wait 10 years for traditional plants to be built…

Enter Small Modular Reactors (SMRs). They are portable, safe, and can be deployed 80% faster than traditional reactors.

There is one firm leading this race. The current Secretary of Energy was a board member. And the company is already working with the U.S. Air Force to power its Arctic bases.

We see it as the solution to the “Build, Baby, Build” mandate in the government’s AI Action Plan.

The Defense Monopoly at the Center of Naval Expansion

Finally, there’s the ultimate defense play.

America is ramping up production of Columbia-class nuclear submarines and selling them to Australia and the U.K.

There is effectively one company that provides the nuclear reactors and fuel for the U.S. Navy’s entire fleet. It is a virtual monopoly.

If the U.S. is going to project power in the Pacific to counter China, this company’s order book is going to explode. It’s a fraction of the size of the major defense contractors, with big upside potential.

The Window Is Closing

The government is moving fast here – so quickly that stocks are moving on rumors alone.

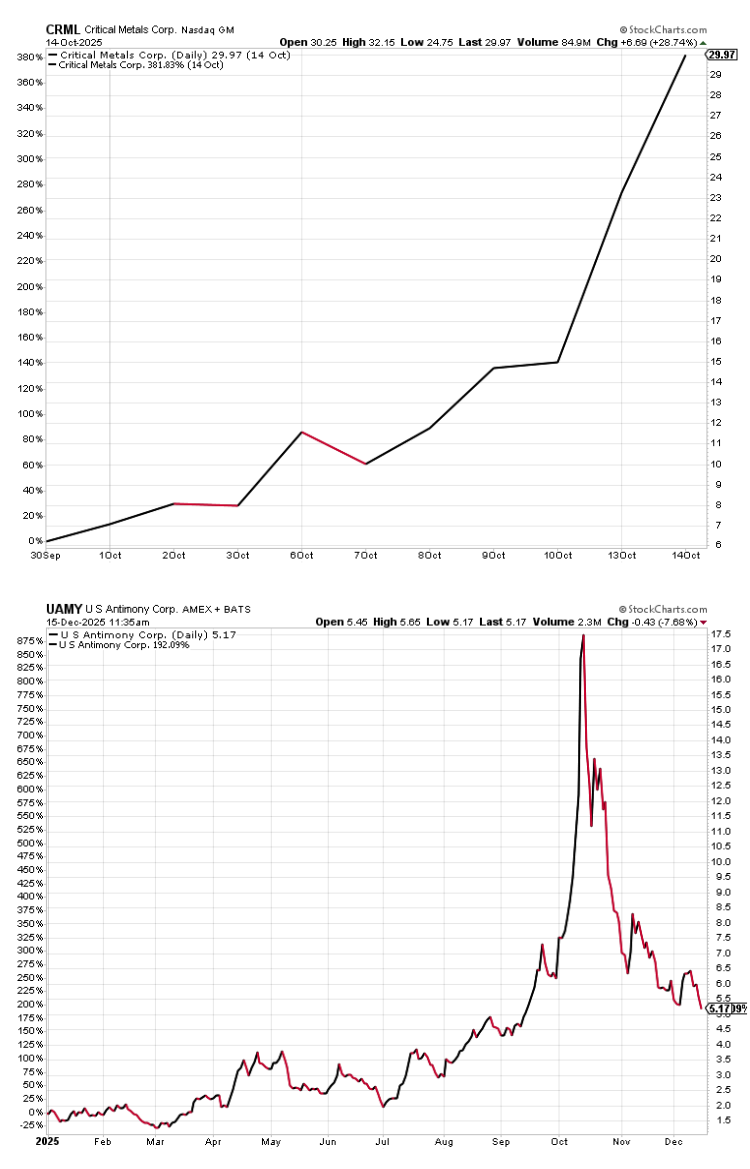

Critical Metals Corp (CRML) soared 275% just on a rumor that it was next in line for a cash injection.

And at one point, United States Antimony (UAMY) was up over 900% this year without a single dollar of government money – just anticipation.

Now imagine what would happen if a check actually clears…

The government has turned the cash spigot on full blast.

You can try to guess which stocks are on its shopping list, scour 13F filings, and comb through government contract databases…

Or, you can watch my new briefing, where I break it all down – because I’ve done the legwork so you don’t have to.

I have compiled all my research on 119 companies – including their names, ticker symbols, buy-up-to prices, and the top 5 to buy right now – in a new report all about ‘The President’s Market.’

The buying spree has started. Don’t wait until the press release drops. By then, it’s too late.

Watch the presentation and get the list of stocks immediately.