The Real Reason the U.S. Took a Stake in Intel Stock

Editor’s Note: Rarely do markets hand us a date circled in red on the calendar: a moment when trillions in sidelined cash could rush back into stocks. But that’s exactly what we’re facing on Sept. 30.

The administration is pulling every lever – reshoring, tariffs, tax breaks – to pump up the economy and stock market ahead of the 2026 midterms. If they succeed, it could unlock as much as $7 trillion in fresh capital. And a big chunk of that money could target a select group of stocks already primed for explosive growth…

That’s where my colleague, legendary investor Louis Navellier, comes in. He has pinpointed five top-rated stocks with 1,000% upside potential if this tidal wave of capital hits. Even better, he’s sharing one free recommendation he believes could double within a week.

Bottom line: when Washington engineers a market surge of this scale, you don’t want to sit on the sidelines. Here’s Louis with the details.

Have a wonderful Labor Day weekend!

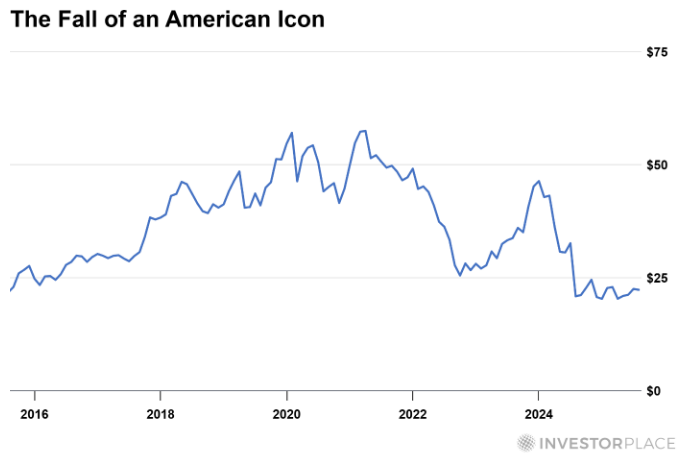

In just a moment, I’m going to show you a chart.

It’s one of the most depressing charts you’ll ever come across in finance.

It shows the stock price of a once-great American company. A blue-chip icon. A testament to American “greatness.”

The only problem? Its stock has gone nowhere over the past 10 years.

I’m talking about Intel Corp. (INTC).

What makes this even harder to stomach is that all of Intel’s missteps happened during the very same period when the AI Boom took off.

Competitors like Nvidia Corp. (NVDA) came along and revolutionized the semiconductor industry. They became the clear-cut leaders of the AI Revolution. Meanwhile, Intel just couldn’t seem to figure it out.

There’s so much unfavorable news about Intel that it’s hard to even know where to start.

Let’s just consider the past year…

- In August 2024, Intel announced plans to slash its headcount by more than 15% as part of a $10 billion cost-savings plan for 2025 – a move that could eliminate nearly 19,000 jobs.

- Around the same time, Intel suspended its dividend, cutting off income-focused investors from even a modest payout.

- Then in December, CEO Pat Gelsinger abruptly retired after failing to turn things around, leaving the company without a clear succession plan.

The financials tell the same story. Last year, Intel lost $0.13 per share on $53.1 billion in revenue. Back in 2021, it earned $4.86 per share on $79 billion in revenue. That’s how far the mighty have fallen.

Now, things may be starting to look up – analysts expect a return to profitability this year. But even then, Intel is only projected to earn $0.12 per share on $52 billion in revenue.

By comparison, Nvidia is expected to grow earnings 46% on $203 billion in revenue – a 56% revenue surge. And over the past five years alone, the stock is up nearly 1,300%.

Don’t get the wrong impression. I’m not trying to denigrate Intel or its shareholders. They’ve suffered enough already.

And yet, despite all this, the U.S. government just made a bold move: It took a 10% stake in Intel.

That raises an important question…

Why in the world would Washington want to invest in a company with so many struggles?

That’s exactly what we’ll discuss today. Because this isn’t the first move the U.S. government has made like this – nor will it be the last.

So, we’ll go over what happened, what the Trump administration might do next – and how investors like you can profit…

Why Washington Chose Intel

So why would the U.S. government step in and take a 10% stake in Intel – a company that has lost ground and stumbled in the chip race?

The short answer: Because despite all its woes, Intel is still the only American company capable of making advanced chips at scale on U.S. soil.

Last week, Commerce Secretary Howard Lutnick confirmed the government invested $8.9 billion into Intel common stock. That gave the U.S. a 10% stake in the company at a discount to the market price – now valued at roughly $11 billion.

The funds came from CHIPS Act grants and secure-chip awards that had already been approved but not yet paid out. The government also secured a warrant to buy another 5% stake if Intel ever loses majority control of its foundry business.

Make no mistake, this is about more than shoring up a troubled stock. This is about national security.

Intel has spent billions building new factories in Ohio – what it calls the “Silicon Heartland” – in a bid to regain ground against Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC). But the company has repeatedly run into delays and cost overruns.

Just last month, new Intel CEO Lip-Bu Tan told employees there would be “no more blank checks.” Intel’s crown jewel factory in Ohio isn’t scheduled to start production until 2030.

Meanwhile, TSMC continues to dominate global chip manufacturing, producing the most advanced semiconductors for Nvidia, Apple Inc. (AAPL), Advanced Micro Devices Inc. (AMD), Qualcomm Inc. (QCOM) – and even Intel itself.

That’s not just disappointing – it’s a serious strategic concern. The West remains heavily reliant on Taiwan, which produces more than 60% of the world’s semiconductors and nearly 90% of advanced chips. If China ever made good on its threats to invade Taiwan, the risks to our supply chain would be catastrophic. (TSMC, for its part, understands this – which is why it’s building new chip foundries in Arizona and elsewhere overseas.)

By taking a stake in Intel, the U.S. government is signaling it won’t allow the country to depend on one small island within striking distance of our biggest adversary for the chips that power everything from iPhones to AI data centers to missile guidance systems.

President Donald Trump called it “a great deal for America and a great deal for Intel.”

White House economic advisor Kevin Hassett went even further, saying this is likely the first of many such deals.

This is industrial policy on steroids, folks – and Intel is just the beginning. In fact, it’s not even the first move…

The First Move: MP Materials

You see, this isn’t the first time the new administration has put real money to work in a strategic company.

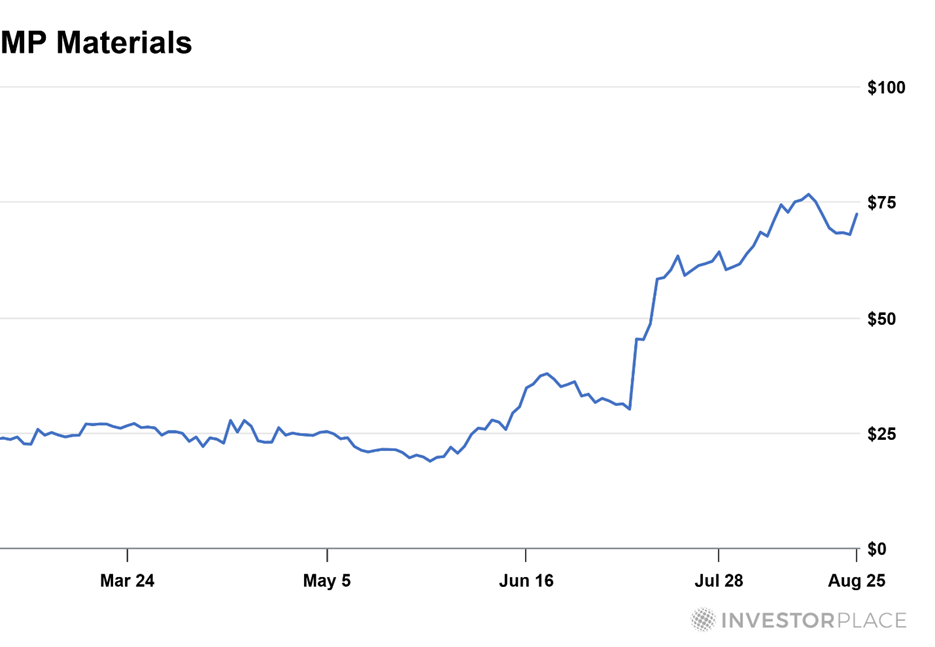

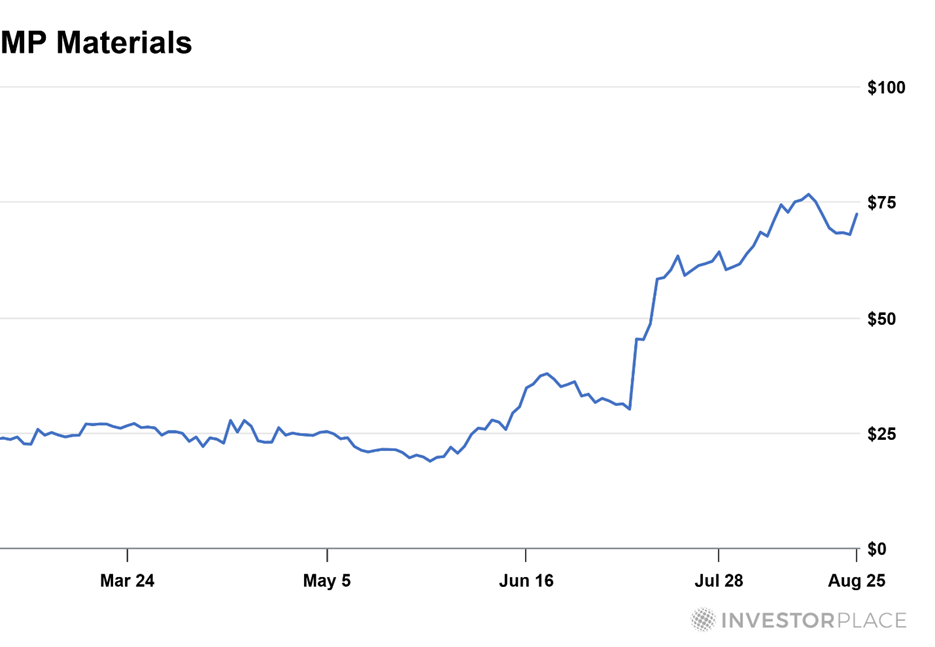

Back in July, the government made a move into MP Materials Corp. (MP), the only U.S. company mining and processing rare-earth minerals at scale.

These metals are absolutely critical to everything from missile guidance systems to EV motors to the permanent magnets used in advanced semiconductors.

In fact, at a special investment briefing before this news, I told folks about MP as a “hidden AI trade”. The next day, this news broke, and the stock promptly doubled in less than a week. That’s the kind of impact direct government support can have.

Why MP Materials? For the same reason Washington just bought a piece of Intel: national security.

Rare earths are a choke point where China dominates. And just like with semiconductors, the U.S. government has no intention of letting a strategic adversary control the materials needed for our defense systems and next-generation technologies.

The MP Materials stake was a clear warning shot. It showed the Trump administration was willing to move beyond grants and subsidies. They are willing to take actual equity stakes in companies if that’s what it takes to protect America’s supply chains.

Intel is simply the next domino to fall. And it won’t be the last…

The Next Domino: Defense Contractors

Now, Intel wasn’t the only name in the headlines this week. Howard Lutnick said on CNBC that the Pentagon is weighing equity stakes in defense contractors like Lockheed Martin Corp. (LMT).

Think about what that means. Washington isn’t just handing out contracts anymore – it’s talking about owning a piece of the very companies that build our fighter jets, missile systems, and next-generation drones.

Why? Because national security depends on it.

Lockheed and its peers are the backbone of America’s military supply chain. But costs are rising, projects are getting more complex, and the geopolitical backdrop is more dangerous than it has been in decades.

The Trump administration wants to make sure these firms have the resources to scale up quickly – and it doesn’t want to leave that mission in the hands of Wall Street alone.

In other words, Washington is moving from regulator to shareholder. That’s a sea change in U.S. industrial policy. First MP Materials. Then Intel. Next, the defense sector.

And, as I noted above, Hassett says there will be “many more deals” like this.

For investors, the message is clear: The government isn’t just influencing markets from the sidelines anymore. It’s stepping directly onto the field.

What This Means for Investors

Taken together, these moves form a clear pattern.

With every executive order, every tariff, and every proclamation and tweet, President Trump has been setting the stage for the most high-stakes moment of his second term.

The administration is pulling out all the stops to unleash what it calls a “stock market boom like the world has never seen.”

And come September 30, I believe President Trump will hold a “big reveal” that will drive $7 trillion – right off the sidelines – and into a handful of select stocks.

In fact, my system has helped me identify five under-the-radar companies I believe could surge 1,000% in the September 30 aftermath. And because they’re smaller names that most investors haven’t heard about, I believe their stocks could skyrocket as the money starts flowing – just like it did with MP Materials.

Click here now to learn the details and get access to a free stock recommendation I urge you to buy now…

The last time I gave out a free pick, it doubled within a week.

Sincerely,

Louis Navellier

Senior Investment Analyst

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Nvidia Corp. (NVDA)