The Labor Market Is Not Ready for What AI Is About to Do

In 1811, as England’s Industrial Revolution was gaining momentum, a group of textile workers decided to fight back.

Led by the mythical ‘General Ludd’ of Sherwood Forest, what began as a concentrated movement in central England quickly spread across the nation. Traditional workers took hammers to the stocking frames and power looms – the machines erasing their jobs, their wages, and centuries of hard-won craft.

They weren’t irrational or anti-progress. They were simply watching their livelihoods evaporate in real time; and they understood that, unfortunately, no one was coming to help them.

History remembers them as the Luddites, a cautionary tale about resisting the inevitable. But what history forgets is that they were right about what would happen to them. The looms won. The weavers lost. And it took generations of political struggle to rebuild something resembling dignity for working people.

Right now, a similar story is beginning to unfold; only instead of stocking frames and power looms, AI is the existential threat.

While investors are worrying about Big Tech’s AI capex, the ground beneath our feet – the very foundation of how we earn a living – is turning into quicksand.

The biggest risk we face isn’t a correction in the Nasdaq. It’s structural: the permanent devaluation of human labor.

Forget a stock market crash. It’s time to prepare for what’s in store for the labor market…

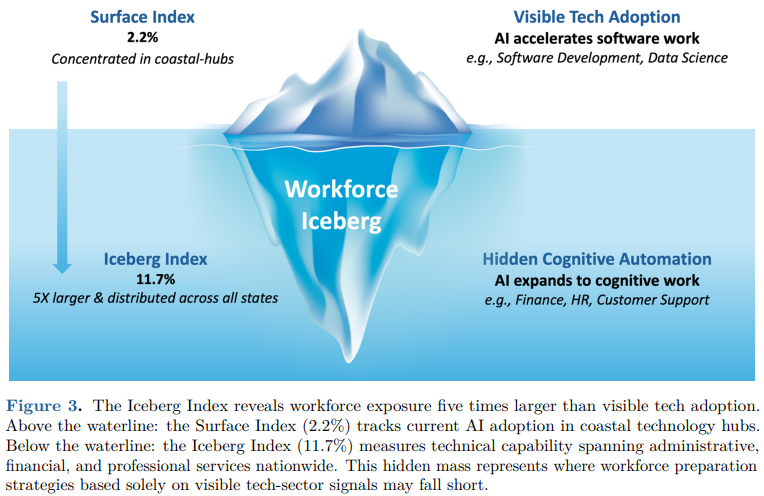

The Iceberg Index: The Truth About AI Job Loss in America

The latest research shows just how far this displacement has already advanced beneath the surface.

MIT, partnering with Oak Ridge National Laboratory, recently released what it calls the “Iceberg Index.” And it’s terrifyingly blunt.

Its models suggest that roughly 12% of existing U.S. jobs are already technically and economically viable for AI replacement right now.

That’s 1 in 9 people whose economic output can be matched by a software subscription that doesn’t need health insurance, doesn’t take bathroom breaks, and doesn’t complain on Slack.

And that’s just based on current technology. We aren’t even talking about what happens when the next iterations of models – like those with the agentic capabilities that we’re seeing in Gemini 3.0 – fully mature.

When an AI can not only write the email but also plan the project, execute the code migration, handle the vendor dispute, and reconcile the budget without human intervention, the need for the human “manager” in the middle evaporates.

We are already seeing the results…

HP Inc. (HPQ) just announced it is cutting up to 6,000 jobs by 2028 to “fund AI investment.” Its CEO openly admitted the goal is to redesign processes with AI agents to save $1 billion.

UPS (UPS) cut 12,000 corporate roles earlier this year, explicitly stating that automation meant those jobs aren’t coming back. Klarna (KLAR) replaced hundreds of customer service agents with an AI that speaks 35 languages and works 24/7. Amazon (AMZN) is undergoing its biggest corporate layoff ever.

This isn’t recessionary. This is a capital pivot. Companies are trading variable-cost, high-maintenance human workers for fixed-cost, exponentially improving silicon ones.

The labor bubble is already leaking.

AI Is Breaking the Link Between Productivity and Wages

The reason this feels different – and increasingly scary – is because it breaks the fundamental pact of modern economics.

For the last century, as technology improved, productivity went up. As productivity went up, wages did, too. A rising tide lifted all boats, even if some boats were lifted higher than others.

But AI is breaking that link.

When a company deploys an AI system that allows it to double its output without hiring a single new employee, where does that extra value go?

It does not go to the remaining workers. It goes to the company’s bottom line, then to dividends, buybacks, and share price appreciation.

This is the brutal arithmetic of the next decade: The slice of the global economic pie going to “wages” will shrink, and the slice going to “profits” (capital) will explode.

And that doesn’t even take an economic downturn into account.

Right now, we have historically low unemployment (around 4%). The economy is showing cracks but is still fairly stable. And yet, companies are aggressively automating.

Imagine what happens in a recession.

Economists call it the ‘cleansing effect.’ When revenue dips, companies are forced to cut costs mercilessly. If we enter a recession, CFOs won’t just trim travel budgets. They’ll take a hard look at that expensive marketing department, compare the capabilities of the latest generative AI tools, and pull the trigger on mass replacement.

It gives them cover. “Due to macroeconomic headwinds, we are restructuring.”

And when the economy recovers, those jobs won’t come back.

The recession will be the accelerant. The recovery will be jobless.

Workers Must Shift From Labor to Capital to Survive the AI Era

So, if the value of labor is crashing and the value of capital is skyrocketing, the solution is uncomfortably simple.

You need to stop thinking like a laborer and start thinking like a capitalist.

If you cannot beat the machines, you must own them.

This brings us to the “stock bubble.” You might be worried that Nvidia (NVDA) is overpriced at its current valuation. Fair enough. But if you have zero exposure to the companies building the infrastructure of the future, you are betting your entire financial existence on your ability to out-work an algorithm that doubles in ability every 18 months.

That is a terrible bet.

The only true hedge against the devaluation of your labor is to own a piece of the entities that are benefiting from that devaluation. You need to be on the receiving end of that wealth transfer.

When HP fires 6,000 people to become more efficient using AI, it’s a tragedy for those 6,000 households. But the cold reality is… it’s a boon for HP shareholders.

If the AI boom continues, these companies will generate unprecedented cash flows. If the ‘AI bubble’ pops, the tech doesn’t go away; it just gets cheaper for companies to deploy, accelerating the labor displacement even faster.

In either scenario, capital wins.

How to Protect Yourself From AI Job Loss: A Two-Part Strategy

Now, I know what you’re thinking. “Great advice. I’ll just take the spare $3 million lying around in my couch cushions and buy a diversified portfolio of AI infrastructure stocks so I can live off the dividends when my job is automated.”

This is the cruelty of the situation. To replace an entire salary with capital returns requires a massive amount of capital that most working professionals simply don’t have.

It’s not fair. In all likelihood, it will exacerbate wealth inequality on a scale we haven’t seen since the Gilded Age. But screaming into the void won’t pay your mortgage in 2028.

You need a barbell strategy for survival.

On the Left: Immediate Financial Exposure

You cannot afford to sit out because the market is “frothy.” You need exposure to the picks and shovels of this gold rush – the chip designers, hyperscale cloud providers, foundational model companies, etc.

Dollar-cost average. Buy ETFs if you don’t know how to pick the winners. Just make sure that as the global economy shifts from running on human calories to running on silicon watts, your portfolio shifts with it.

On the Right: Become ‘Human Capital’

Until you have enough financial capital to retire, your labor is still your primary asset. You have to upgrade it.

The labor market is bifurcating into two categories:

- Commodity Labor: Work that follows a script, processes information, or creates generic content. The value of this is heading toward zero.

- Agency Labor: Work that requires high-level judgment, manages complex systems, owns outcomes, and – crucially – manages the AI agents.

You need the latter. Stop writing copy. Start orchestrating the brand voice that AI brings to life.

The people who will thrive in the transition period aren’t just the ones owning Nvidia stock. They are the ones who can walk into a panicked C-suite and say: “I can replace your inefficient 20-person department with myself, three sharp lieutenants, and a fleet of AI agents – and save you 40%.”

Wield AI as a weapon for your own advancement.

The Labor Market Is Approaching a Breaking Point

Exponential curves look flat for a long time – and then, suddenly, they go vertical.

We are right at the knee of that curve. The window to prepare is closing faster than most think.

It’s best to stop agonizing about whether we are in a 2000s-style stock bubble. A stock market crash hurts your portfolio temporarily. A structural shift in the value of human labor hurts your family permanently.

The old world is dying. You can either own the future, or be replaced by it.

The last time machines replaced workers, steam powered the factories. This time, AI is driving the revolution – and it requires considerably more energy.

As data centers multiply and automation spreads, America faces an AI-driven power crisis.

Washington knows it; and it’s already placing strategic bets to secure our nation’s dominance.

In just the past 90 days, the U.S. government has taken equity stakes in several small American firms – like MP Materials (MP) (+111%), Lithium Americas (LAC) (+194%), and Trilogy Metals (TMQ) (+211%) – each surging triple digits after their deals were announced.

Now I believe I’ve found the next White House Windfall: a small, politically connected nuclear energy company at the center of America’s AI power transformation.

AI may be replacing jobs – but it’s also creating one of the last great wealth transfers of our lifetime.

Click here to learn how to position before the next White House-backed breakout.