Fed Update Clears the Runway for a Year-End Rally

Santa Claus just got clearance from the control tower.

The Federal Reserve has stepped out of the market’s way – and, in doing so, effectively gave stocks the green light to run into the year’s end.

Yes, it was a messy Fed Day. Jerome Powell delivered remarks that made bond traders wince and Twitter economists spiral. The market chopped around for a few hours as everyone debated whether “close to neutral” means cuts are ‘paused’… or ‘cancelled.’

But once you strip away the digital chatter and intraday noise, the message is crystal clear: the Fed is no longer an obstacle to higher equity prices.

And at the same time, the AI Boom is getting stronger and more undeniable by the week.

That combination – easing monetary policy plus accelerating technological growth – is rocket fuel for stocks going into the end of the year.

As I’ve been telling my coworkers… it’s time to Ho, Ho, Go.

Let’s break down why today’s Fed decision could spark a Santa Rally on Wall Street.

Fed Update: Not Perfect, But Bullish Enough for Markets

Going into Wednesday’s Fed meeting, markets had four boxes they wanted checked:

- A rate cut

- A more dovish economic outlook

- A balanced official statement

- Dovish remarks in the post-meeting presser

The central bank checked three out of four. And frankly, that’s a bigger win than most investors are willing to admit.

We got the quarter-point rate reduction.

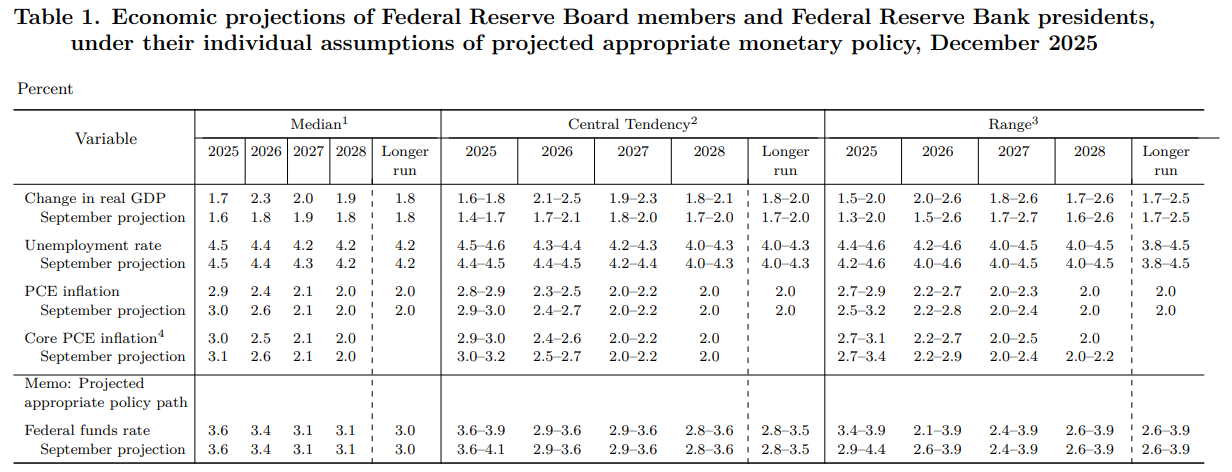

We got a dovish-leaning Summary of Economic Projections. GDP forecasts nudged higher. Inflation forecasts edged lower. Future rate-cut expectations stayed alive. (And that combo screams ‘soft landing,’ no matter how many verbal caveats Powell adds.)

We also got a balanced statement that kept further easing on the table:

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

The only disappointment? Fed Board Chair Jerome Powell’s talking points.

In the press conference, he leaned hawkish, suggesting the Fed is close enough to neutral to justify waiting on more rate cuts.

Cue the hand-wringing and arguments that the Fed just killed the rally.

Except… it didn’t.

Markets didn’t crash. Financial conditions didn’t tighten meaningfully. Risk assets didn’t unravel. Treasury yields didn’t spike. The dollar didn’t squeeze everything in sight.

Instead, everything kind of turned positive – the market’s way of saying, “We’re processing, not panicking; but this does look good.”

And there’s a good reason for that steadiness: the most important part of this Fed update wasn’t verbal at all.

The Fed’s Dot Plot Tells the Real Story

We noticed a detail within the Fed’s latest update that it seems most investors glossed over: the dot plot doesn’t agree with Powell.

The Fed is now openly divided into two camps:

- One led by Powell, seeking to hold rates steady

- Another led by Stephen Miran, hoping for further/larger cuts

That alone tells you uncertainty is high. And importantly, the cut-more camp’s influence is about to rise substantially.

As Powell approaches the end of his term as board chair, political and institutional gravity is shifting. National Economic Council Director Kevin Hassett – widely expected to replace Powell – is firmly in favor of more cuts.

So, when Powell says ‘we might pause,’ the markets know that lull likely has an expiration date.

That’s why we view Wednesday’s Fed decision as confirmation, not contradiction, of our long-held view that rates will go materially lower in 2026.

And equity markets don’t wait around politely for cuts to happen.

They front-run them.

Lower Rates and Explosive AI Growth Create Melt-Up Conditions

The AI Boom did not care about Fed Day.

Enterprise AI demand remains red-hot. AI capex plans are still aggressive. AI earnings are coming in strong. And AI timelines keep pulling forward.

Big Tech is accelerating, whether the central bank were to hike, pause, or cut.

Cloud spend tied directly to AI workloads continues to grow. Custom silicon investment is exploding. AI software penetration is still in the early innings. Governments are openly discussing AI as a strategic national priority. And corporate balance sheets are being reshaped around automation, intelligence, and scale.

That’s why earnings surprises keep skewing positive in AI-exposed sectors, why guidance keeps improving, why capital keeps flowing into the same theme, month after month.

And crucially…

AI growth does not require rate cuts to exist. It merely benefits from them.

Markets thrive when two forces – earnings growth and multiple expansion – align.

Well, AI is driving strong earnings growth. And the Fed just removed the biggest obstacle to multiple expansion.

When rates stop rising – and especially when cuts begin – valuation ceilings lift. Risk tolerance improves. Capital rotates out the sidelines and back into growth.

That’s how you get melt-ups.

In other words, today’s setup looks a lot like other powerful year-end rallies we’ve seen: uncertainty early, skepticism mid-stream, then a rapid shift toward participation as investors realize they’re underexposed.

And that shift may already be underway.

Santa Just Got Clearance from the Control Tower

With Fed Day now behind us, investors’ anxiety is shifting – from ‘macro’ to ‘FOMO.’

Funds that stayed cautious waited too long and will chase. Risk managers will loosen up as they realize volatility is contained.

Meanwhile, AI-linked leaders keep breaking higher, pulling indices with them.

This is how Santa rallies are born – when good-enough policy meets undeniable growth.

The Fed didn’t promise the moon, slam on the brakes, or completely throw caution to the wind.

It did the most bullish thing possible at this stage and stepped aside.

The hiking cycle is definitively over. Leadership at the Fed is shifting dovish.

And all the while, the AI Boom continues to compound underneath everything like a rising tide.

That’s why we believe stocks are set to soar into year-end.

Santa filed his flight plan, got FAA approval… and now the runway is clear.

But this year, Rudolph is on vacation.

The federal government is the one guiding Santa’s sleigh.

The Trump administration has launched a massive stock buying spree – and the stocks involved are soaring in value faster than almost anything else in the market.

First, Washington bought MP Materials (MP), driving it 50% higher in a day. Next came Lithium Americas (LAC) – which doubled in 24 hours. Then, the Pentagon poured tens of millions of dollars into Trilogy Metals (TMQ); and it rose 200% overnight.

Clearly, when the federal government starts writing checks, the companies cashing them see fast-and-furious stock gains. And investors positioned before the announcement comes enjoy the juiciest returns.

So, which stock will Washington target next? And where should you move your money to capitalize?

Everything you need to know is right here.

P.S. While the Fed greenlights a year-end rally, Louis, Eric, and I see a much bigger force brewing: an $11.3 trillion economic shift, starting in just a few weeks on January 2, 2026.

Together, we’ve identified a handful of small U.S. suppliers that could return 2,400%–8,500% as corporate and government capital floods into AI infrastructure, reshoring, and nuclear power.

Find out their names and ticker symbols here.